Guidance & Outlook

This page contains non-GAAP measures and forward-looking information about expected future events and financial and operating performance of the Company. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

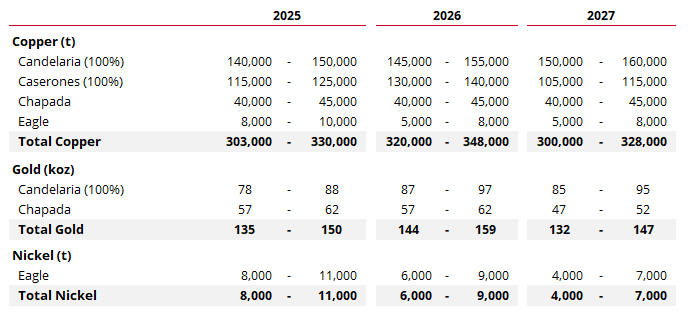

Production Outlook1

2025 Cash Cost Guidance2,3,4,5

Lundin's consolidated C1 cash cost is forecast to be $2.05 - $2.30/lb of copper, after by-product credits.

- Candelaria’s cash cost is forecast to be $1.80/lb - $2.00/lb of copper, after by-product credits.

- Caserones cash cost is forecast to be $2.40/lb – $2.60/lb of copper, after by-product credits.

- Chapada's cash cost is forecast to be $1.80/lb – $2.00/lb of copper in 2025, after unencumbered gold by-product credits.

- Eagle's cash cost is forecast to be $3.05/lb – $3.25/lb of nickel in 2025, after by-product copper credits.

|

Cash Cost |

2025 |

|||||||||

|

Copper |

||||||||||

|

Candelaria |

$1.80/lb |

- |

$2.00/lb |

|||||||

|

Caserones |

$2.40lb |

- |

$2.60/lb |

|||||||

|

Chapada |

$1.80/lb |

- |

$2.00/lb |

|||||||

| Lundin Consolidated C1 Cash Cost | $2.05/lb | - | $2.30/lb | |||||||

|

Nickel |

||||||||||

|

Eagle |

$3.05/lb |

- |

$3.25/lb |

|||||||

2025 Capital Expenditure Guidance2

|

Capital Expenditures ($ millions) |

2025 |

|

|

Sustaining Capital |

||

|

Candelaria (100% basis) |

$205 |

|

|

Caserones (100% basis) |

$215 |

|

|

Chapada |

$85 |

|

|

Eagle |

$25 |

|

|

Total Sustaining Capital |

$530 |

|

|

Candelaria (100%) |

$50 |

|

|

Vicuña |

$155 |

|

|

Total Expansionary Expenditures |

$205 |

|

|

Total Capital Expenditures |

$735 |

|

2025 Exploration Expenditure Guidance

Exploration expenditures are planned to be $40 million in 2025 primarily for in-mine and near-mine targets at our operations. The largest portion of the planned expenditure will be at Caserones where drilling (18,000 meters (m)) and geophysical programs are planned. Significant drilling programs are also planned at Candelaria (18,000 m), and Chapada (20,000 m) with the goal to grow resources. The drill program at Caserones will focus on deeper in-pit drilling to better define higher grade breccia zones and exploration drilling to continue testing the sulphide mineral potential below the Angelica oxide deposit. At Candelaria drilling is designed to continue expanding the underground resources, while also growing the shallow La Española Deposit and neighboring La Portuguesa target area. At Chapada additional drilling at Sauva will continue to further define higher grade resources that will be incorporated into an updated resource estimate.

Vicuña is currently undertaking a drill program at FDS and Cumbre Verde that will continue throughout the year. The drill program will focus on resource growth with multiple step-out targets in all directions from zones of known mineralization, including both the Bonita and Aurora Zones along with infill drilling to support an initial mineral resource estimate mid-year. Drilling at Cumbre Verde will follow up on the initial results from last year and target the same mineralized system and structures discovered to the north of the project.

1. Production guidance is based on certain estimates and assumptions, including but not limited to: Mineral Resources and Mineral Reserves, geological formations, grade and continuity of deposits and metallurgical characteristics.

2. Cash costs and expansionary capital expenditures are non-GAAP measures. Please also see the Management’s Discussion and Analysis for the year ended December 31, 2024, for discussion of non-GAAP measures and other performance measures. 2025 cash costs and capital expenditures are based on various assumptions and estimates, including, but not limited to: production volumes, commodity prices (2025 - Cu: $4.40/lb, Mo: $17.00/lb, Au: $2,500/oz: Ag: $30.00/oz) foreign currency exchange rates (2025 - CLP/USD:900, USD/BRL:5.50).

3. 68% of Candelaria’s total gold and silver production are subject to a streaming agreement and as such cash costs are calculated based on receipt of $433/oz and $4.32/oz, respectively, on gold and silver sales in the year. No consideration has been made for the upfront payment recieved in the calculation of cash costs.

4. Chapada cash costs are calculated on a by-product basis and do not include the effects of copper stream agreements. Effects of copper stream agreements are reflected in copper revenue and will impact realized revenue per pound.