News

Lundin Mining Announces New Copper-Gold Saúva Discovery at Chapada

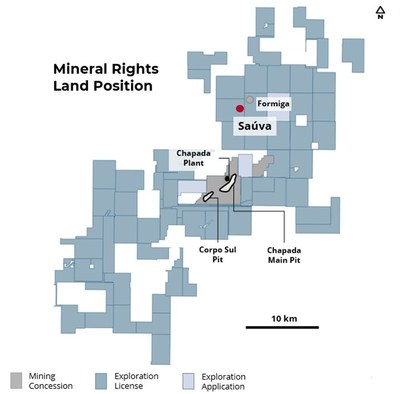

TORONTO, Feb. 10, 2022 /CNW/ - (TSX: LUN) (Nasdaq Stockholm: LUMI) Lundin Mining Corporation (“Lundin Mining” or the “Company”) today announces the discovery of a new copper-gold mineralized system called Saúva, located approximately 15 kilometers north of the Chapada mine, in the State of Goiás, Brazil.

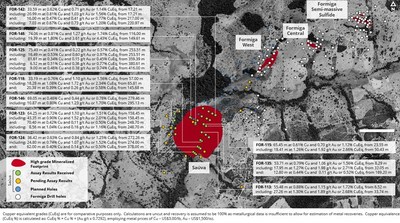

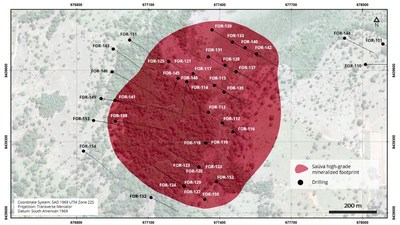

As part of Lundin Mining’s ongoing exploration program aimed at increasing the Mineral Resource estimation at Chapada, diamond drilling was initiated at Saúva in the third quarter of 2021 within a recently acquired exploration concession (Figure 1). Initial drilling was designed to test for the source of a strong soil copper anomaly (>1,000 ppm Cu) that was located along strike from the previously identified Formiga prospect. The first two drill holes at Saúva confirmed the presence of shallow high-grade copper-gold mineralization. Further drilling was undertaken to evaluate the potential and to date a total of forty-seven (47) holes have been completed defining a mineralized area measuring approximately 750 meters by 650 meters, with assay results available for 29 holes (Table 1). The mineralization currently remains open in all directions.

Highlights from initial drilling include:

- Hole FOR-113: 55.48 m at 0.88% Cu and 1.15 g/t Au or 1.72% CuEq1, from 6.52 m

including: 27.26 m at 1.30% Cu and 1.89 g/t Au or 2.68% CuEq, from 33.74 m - Hole FOR-115: 65.45 m at 0.61% Cu and 0.70 g/t Au or 1.12% CuEq, from 23.55 m

including: 18.41 m at 1.26% Cu and 1.92 g/t Au or 2.66% CuEq, from 50.43 m - Hole FOR-123: 64.25 m at 0.72% Cu and 1.10 g/t Au or 1.51% CuEq, from 158.45 m

including: 43.25 m at 0.90% Cu and 1.52 g/t Au or 2.01% CuEq, from 158.45 m

and: 70.40 m at 0.42% Cu and 0.11 g/t Au or 0.50% CuEq, from 248.70 m

including: 8.56 m at 1.04% Cu and 0.16 g/t Au or 1.16% CuEq, from 248.70 m - Hole FOR-135: 57.31 m at 0.79% Cu and 1.06 g/t Au or 1.56% CuEq, from 8.29 m

including: 17.95 m at 1.27% Cu and 1.98 g/t Au or 2.71% CuEq, from 32.05 m

and: 12.80 m at 0.44% Cu and 0.11 g/t Au or 0.52% CuEq, from 189.20 m - Hole FOR-148: 74.06 m at 0.81% Cu and 1.27 g/t Au or 1.74% CuEq, from 116.00 m

including: 19.39 m at 1.80% Cu and 3.61 g/t Au or 4.43% CuEq, from 149.61 m

Lundin Mining President and CEO, Peter Rockandel, commented “The shallow and high-grade copper-gold mineralization discovered at Saúva is a clear example of the growth optionality that stems from Lundin Mining’s successful track record of aggressive near-mine and brownfields exploration at all of our operations. Implications that this new high-grade mineralized system may have for our on-going expansion studies of Chapada will be evaluated as this discovery evolves during the year.”

Ciara Talbot, Vice President, Exploration, added “We are very pleased with this early-stage discovery within the exploration concessions identified and acquired as part of last year’s federal auction process. This discovery supports our view that numerous opportunities exist to increase the size and quality of our Mineral Resource base at Chapada.”

_____________ |

1 Copper equivalent grades (CuEq) are for comparative purposes only. Calculations are uncut and recovery is assumed to be 100% as metallurgical data is insufficient to allow for estimation of metal recoveries. Copper equivalence (CuEq %) is calculated as: CuEq % = Cu % + (Au g/t x 0.7292), employing metal prices of Cu – US$3.00/lb, Au – US$1,500/oz. |

Saúva Discovery

In 2015, the Chapada exploration team identified the Formiga exploration target, approximately 15 km north of the mine, based on positive chip sampling and regional mapping. The first drill holes at Formiga intercepted skarn style alteration comprising hydrothermal assemblage of garnet-epidote-amphibole-diopside in metasedimentary rocks. Then, during soil sampling in the region in 2016, additional disseminated copper-gold targets in the Formiga sector were identified along strike in metadiorite with hydrothermal alteration similar to what is being mined at Chapada. This trend of mineralized occurrences appeared to extend off the exploration concession to the west.

Following the acquisition of Chapada by Lundin Mining in 2019, a Mineral Inventory Range Analysis study was undertaken to refine the exploration strategy, including the prioritization of potential mineral concession acquisitions ahead of the anticipated federal auction. In the first half of 2021, Lundin Mining acquired 37 new exploration concessions through the auction process, covering 58,048 hectares and increasing the total land position around the Chapada mine by over 120%. This included the concession immediately west of Formiga. Two initial drill holes, FOR-112 and FOR-113, were designed to test for the source of a strong soil copper anomaly (>1,000 ppm Cu) on this newly acquired concession along strike from Formiga. Both drill holes confirmed the presence of shallow high-grade copper-gold mineralization, which has become the Saúva prospect discovery.

Saúva Exploration Results

Following the initial discovery of the Saúva in September 2021, an aggressive exploration drilling campaign was commenced with five drill rigs to better define the potential size of the discovery. Forty-three (43) drill holes, totaling 12,850 meters, had been completed at Saúva as of December 2021. Almost all drill holes intercepted the mineralized layer containing high chalcopyrite with (±) bornite content and with the majority returning intersections with grades above 1.0% CuEq, confirming the potential for significant, shallow and high-grade copper-gold mineralization. The location of the drill hole collars are shown in Figures 2 and 3, along with an approximate outline of where mineralized horizons have been intersected. The mineralization continues to remain open in all directions.

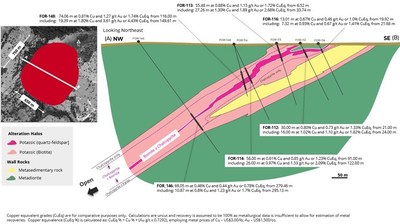

Mineralization at Saúva is comprised of disseminated and vein-hosted bornite and chalcopyrite hosted by biotitic and quartz-feldspar altered rocks. The high-grade mineralization (>1.0% CuEq) is associated with bornite greater than chalcopyrite, or chalcopyrite greater than bornite sulfide zones. Lower grade mineralization (>0.3% CuEq) is associated with chalcopyrite and pyrite + chalcopyrite sulfide zones. A representative cross section of the mineralized horizons is presented in Figure 4. The hydrothermal alteration zone is currently interpreted to generally follow a northeast trend, but individual high-grade orientations vary and detailed modeling remains in progress.

2022 Exploration Program

Lundin Mining is evaluating and interpreting the results reported in Table 1 and continues to explore for extensions to the mineralization. There are presently three rigs drilling in the Saúva sector testing areas to the northeast and west of the discovery area. Aggressive and methodical exploration of the sector is planned for 2022 as part of the $10 million exploration program at Chapada. Additional drill rigs and approximately fifty (50) holes are planned to test northeast along strike to towards the Formiga sector, as well as step out in other directions, as seen in Figure 2.

Technical Information and Quality Assurance

The drill holes were collared at HQ diameter from soil to altered rock and changed to NQ when fresh rock was encountered. The drill rods were three meters long and the wireline core drilling method was employed. The majority of holes were drilled at an azimuth of 120° and a 70° dip, perpendicular to interpreted strike and the mineralized horizon. However, some holes were drilled at other orientations where ideal surface access was not possible at the time. Downhole surveys were taken by the drilling contractor upon completion of the drill hole. All drill holes were surveyed every three (3) meters downhole using a Reflex GYRO SPRINT-IQ™ electronic surveying instrument. Generally, the deviation was below 5%, and no significant deviation issues were found to date. Collar surveys were taken by GPS with CenterPoint RTX in UTM coordinates, SAD 69 Brazil datum, 22 South Zone. Drill hole collars were cased and protected at the surface with a cement block affixed with a metal tag stamped with the drill hole number, final depth, inclination, azimuth, and start and finish dates.

All Lundin Mining assay results from drilling have been independently monitored through a quality assurance/quality control (“QA/QC”) program, including the insertion of blind standards, duplicates, blanks, and pulp and reject duplicate samples. The soil, saprolite, and altered rock were drilled from HQ size core and the fresh rock from NQ size core. Half of the core was collected, and the sample interval was around one (1) meter for mineralized zones and two (2) meters for non-mineralized zones. Quarter core samples were collected for duplicate analysis. The samples were securely transported by a locally based transport company from our core preparation facility at the Chapada Mine, Brazil to the ALS Chemex sample preparation facility in Goiania, Brazil. Sample pulps were sent for analysis to the same lab in Lima, Peru, which is independent of Lundin Mining. The samples were analyzed by fire assay/atomic absorption spectroscopy (AAS) (gold) and four acid digestion/ICP-MS (copper). The analysis was conducted by ALS Chemex Lima, Peru, accredited by the Standards Council of Canada ISO 17025:2005, and the secondary laboratory SGS GEOSOL, Vespasiano, Brazil accredited by ISO 9001:2008, both independent laboratories.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Mr. Jeremy Weyland, P.Eng., Senior Manager Studies of the Company, a non-Independent “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Weyland has verified the data disclosed in this press release and no limitations were imposed on his verification process.

About Lundin Mining

Lundin Mining is a diversified Canadian base metals mining company with operations in Brazil, Chile, Portugal, Sweden and the United States of America, primarily producing copper, zinc, gold and nickel.

The information in this release is subject to the disclosure requirements of Lundin Mining under the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out below on February 10, 2022 at 17:00 Eastern Time.

Cautionary Statement on Forward-Looking Information

Certain of the statements made and information contained herein is “forward-looking information” within the meaning of applicable Canadian securities laws. All statements other than statements of historical facts included in this document constitute forward-looking information, including but not limited to statements regarding the Company’s plans, prospects and business strategies; the Company’s guidance on the timing and amount of future production and its expectations regarding the results of operations; expected costs; permitting requirements and timelines; timing and possible outcome of pending litigation; the results of any Preliminary Economic Assessment, Feasibility Study, or Mineral Resource and Mineral Reserve estimations, life of mine estimates, and mine and mine closure plans; anticipated market prices of metals, currency exchange rates, and interest rates; the development and implementation of the Company’s Responsible Mining Management System; the Company’s ability to comply with contractual and permitting or other regulatory requirements; anticipated exploration and development activities at the Company’s projects; and the Company’s integration of acquisitions and any anticipated benefits thereof. Words such as “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “goal”, “aim”, “intend”, “continue”, “budget”, “estimate”, “may”, “will”, “can”, “could”, “should”, “schedule” and similar expressions identify forward-looking statements.

Forward-looking information is necessarily based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management, including that the Company can access financing, appropriate equipment and sufficient labor; assumed and future price of copper, nickel, zinc, gold and other metals; anticipated costs; ability to achieve goals; the prompt and effective integration of acquisitions; that the political environment in which the Company operates will continue to support the development and operation of mining projects; and assumptions related to the factors set forth below. While these factors and assumptions are considered reasonable by Lundin Mining as at the date of this document in light of management’s experience and perception of current conditions and expected developments, these statements are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: risks inherent in mining including but not limited to risks to the environment, industrial accidents, catastrophic equipment failures, unusual or unexpected geological formations or unstable ground conditions, and natural phenomena such as earthquakes, flooding or unusually severe weather; uninsurable risks; global financial conditions and inflation; changes in the Company’s share price, and volatility in the equity markets in general; volatility and fluctuations in metal and commodity prices; the threat associated with outbreaks of viruses and infectious diseases, including the COVID-19 virus; changing taxation regimes; reliance on a single asset; delays or the inability to obtain, retain or comply with permits; risks related to negative publicity with respect to the Company or the mining industry in general; health and safety risks; exploration, development or mining results not being consistent with the Company’s expectations; unavailable or inaccessible infrastructure and risks related to ageing infrastructure; actual ore mined and/or metal recoveries varying from Mineral Resource and Mineral Reserve estimates, estimates of grade, tonnage, dilution, mine plans and metallurgical and other characteristics; risks associated with the estimation of Mineral Resources and Mineral Reserves and the geology, grade and continuity of mineral deposits including but not limited to models relating thereto; ore processing efficiency; community and stakeholder opposition; information technology and cybersecurity risks; potential for the allegation of fraud and corruption involving the Company, its customers, suppliers or employees, or the allegation of improper or discriminatory employment practices, or human rights violations; regulatory investigations, enforcement, sanctions and/or related or other litigation; uncertain political and economic environments, including in Brazil and Chile; risks associated with the structural stability of waste rock dumps or tailings storage facilities; estimates of future production and operations; estimates of operating, cash and all-in sustaining cost estimates; civil disruption in Chile; the potential for and effects of labor disputes or other unanticipated difficulties with or shortages of labor or interruptions in production; risks related to the environmental regulation and environmental impact of the Company’s operations and products and management thereof; exchange rate fluctuations; reliance on third parties and consultants in foreign jurisdictions; climate change; risks relating to attracting and retaining of highly skilled employees; compliance with environmental, health and safety laws; counterparty and credit risks and customer concentration; litigation; risks inherent in and/or associated with operating in foreign countries and emerging markets; risks related to mine closure activities and closed and historical sites; changes in laws, regulations or policies including but not limited to those related to mining regimes, permitting and approvals, environmental and tailings management, labor, trade relations, and transportation; internal controls; challenges or defects in title; the estimation of asset carrying values; historical environmental liabilities and ongoing reclamation obligations; the price and availability of key operating supplies or services; competition; indebtedness; compliance with foreign laws; existence of significant shareholders; liquidity risks and limited financial resources; funding requirements and availability of financing; enforcing legal rights in foreign jurisdictions; dilution; risks relating to dividends; risks associated with acquisitions and related integration efforts, including the ability to achieve anticipated benefits, unanticipated difficulties or expenditures relating to integration and diversion of management time on integration; activist shareholders and proxy solicitation matters; and other risks and uncertainties, including but not limited to those described in the “Risk and Uncertainties” section of the Annual Information Form and the “Managing Risks” section of the Company’s MD&A for the year ended December 31, 2020, which are available on SEDAR at www.sedar.com under the Company’s profile. All of the forward-looking statements made in this document are qualified by these cautionary statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, forecast or intended and readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Accordingly, there can be no assurance that forward-looking information will prove to be accurate and forward-looking information is not a guarantee of future performance. Readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this document. The Company disclaims any intention or obligation to update or revise forward–looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.

Table 1 – Saúva Discovery Drilling Assay Results To date

Drill Hole | Easting | Northing | Elevation | AZ (o) | DIP (o) | EOH (m) | From (m) | To (m) | Core Interval1 (m) | Cu (%) | Au (g/t) | CuEq2 (%) | Zone |

FOR-112 | 677410.225 | 8439378.835 | 323.47 | 120 | -65 | 200.46 | 21.00 | 51.00 | 30.00 | 0.80 | 0.73 | 1.33 | Upper |

including | 24.00 | 40.00 | 16.00 | 1.02 | 1.10 | 1.82 | Upper | ||||||

FOR-113 | 677352.018 | 8439423.823 | 324.20 | 120 | -75 | 201.14 | 6.52 | 62.00 | 55.48 | 0.88 | 1.15 | 1.72 | Upper |

including | 33.74 | 61.00 | 27.26 | 1.30 | 1.89 | 2.68 | Upper | ||||||

FOR-114 | 677261.126 | 8439551.947 | 324.58 | 160 | -65 | 278.21 | 91.00 | 149.00 | 58.00 | 0.61 | 0.85 | 1.23 | Upper |

including | 122.0 | 148.00 | 26.00 | 0.97 | 1.53 | 2.09 | Upper | ||||||

FOR-115 | 677377.343 | 8439536.486 | 323.93 | 120 | -65 | 269.31 | 23.55 | 89.00 | 65.45 | 0.61 | 0.70 | 1.12 | Upper |

including | 50.43 | 68.84 | 18.41 | 1.26 | 1.92 | 2.66 | Upper | ||||||

FOR-116 | 677454.932 | 8439341.012 | 323.64 | 120 | -65 | 179.73 | 19.92 | 32.93 | 13.01 | 0.67 | 0.46 | 1.00 | Upper |

including | 21.68 | 29.00 | 7.32 | 0.93 | 0.67 | 1.41 | Upper | ||||||

FOR-117 | 677288.243 | 8439585.696 | 324.85 | 120 | -70 | 309.07 | 115.00 | 153.00 | 38.00 | 0.53 | 0.55 | 0.93 | Upper |

including | 117.00 | 135.10 | 18.10 | 0.71 | 0.97 | 1.42 | Upper | ||||||

and | 260.15 | 283.00 | 22.85 | 0.43 | 0.27 | 0.62 | Lower | ||||||

FOR-118 | 677341.880 | 8439294.204 | 326.11 | 300 | -70 | 219.21 | 57.00 | 90.19 | 33.19 | 0.76 | 1.10 | 1.56 | Upper |

including | 65.81 | 84.09 | 18.28 | 1.08 | 1.72 | 2.34 | Upper | ||||||

and | 145.68 | 166.06 | 20.38 | 0.39 | 0.26 | 0.58 | Lower | ||||||

FOR-119 | 677340.468 | 8439295.041 | 326.24 | 120 | -75 | 175.43 | 50.34 | 74.00 | 23.66 | 0.70 | 0.59 | 1.13 | Upper |

including | 50.34 | 61.45 | 11.11 | 0.97 | 1.11 | 1.79 | Upper | ||||||

FOR-120 | 677313.055 | 8439192.795 | 323.97 | 300 | -70 | 238.35 | 79.00 | 127.30 | 48.30 | 0.46 | 0.22 | 0.62 | Upper |

including | 79.00 | 89.26 | 10.26 | 0.65 | 0.62 | 1.11 | Upper | ||||||

FOR-121 | 677185.302 | 8439637.543 | 325.94 | 120 | -70 | 370.39 | 199.20 | 249.00 | 49.80 | 0.52 | 0.32 | 0.75 | Upper |

including | 199.20 | 209.24 | 10.04 | 0.65 | 1.03 | 1.40 | Upper | ||||||

including | 228.00 | 240.00 | 12.00 | 0.83 | 0.12 | 0.92 | Upper | ||||||

and | 307.00 | 334.00 | 27.00 | 0.49 | 0.22 | 0.65 | Lower | ||||||

including | 101.23 | 333.00 | 9.00 | 0.75 | 0.36 | 1.01 | Lower | ||||||

FOR-122 | 677312.73 | 8439193.899 | 324.03 | 120 | -80 | 191.80 | 96.38 | 124.00 | 27.62 | 0.32 | 0.23 | 0.49 | Lower |

including | 101.23 | 113.80 | 12.57 | 0.32 | 0.33 | 0.56 | Lower | ||||||

FOR-123 | 677312.36 | 8439193.312 | 323.79 | 300 | -50 | 401.16 | 158.45 | 222.70 | 64.25 | 0.72 | 1.10 | 1.51 | Upper |

including | 158.45 | 201.80 | 43.34 | 0.90 | 1.52 | 2.01 | Upper | ||||||

and | 248.70 | 319.10 | 70.40 | 0.42 | 0.11 | 0.50 | Lower | ||||||

including | 248.70 | 257.26 | 8.56 | 1.04 | 0.16 | 1.16 | Lower | ||||||

FOR-124 | 677250.367 | 8439112.094 | 324.01 | 300 | -50 | 472.06 | 272.26 | 308.68 | 36.42 | 0.63 | 0.84 | 1.25 | Upper |

including | 274.00 | 298.80 | 24.80 | 0.74 | 1.07 | 1.52 | Upper | ||||||

and | 378.00 | 440.00 | 62.00 | 0.40 | 0.14 | 0.50 | Upper | ||||||

FOR-125 | 677186.692 | 8439636.057 | 325.10 | 300 | -85 | 451.03 | 253.51 | 329.00 | 75.49 | 0.41 | 0.22 | 0.57 | Upper |

including | 253.51 | 270.70 | 16.49 | 0.53 | 0.60 | 0.97 | Upper | ||||||

and | 359.39 | 441.00 | 81.61 | 0.34 | 0.15 | 0.45 | Lower | ||||||

including | 380.61 | 387.13 | 6.52 | 0.51 | 0.36 | 0.77 | Lower | ||||||

including | 416.00 | 425.00 | 9.00 | 0.46 | 0.38 | 0.74 | Lower | ||||||

FOR-127 | 677249.706 | 8439112.792 | 324.03 | 120 | -85 | 288.75 | 105.00 | 165.56 | 60.56 | 0.27 | 0.12 | 0.36 | Upper |

FOR-128 | 677422.175 | 8439621.234 | 324.79 | 120 | -70 | 289.99 | 60.41 | 103.00 | 42.59 | 0.50 | 0.45 | 0.83 | Upper |

including | 60.41 | 77.00 | 16.59 | 0.78 | 0.87 | 1.41 | Upper | ||||||

and | 245.22 | 279.22 | 34.00 | 0.39 | 0.30 | 0.61 | Lower | ||||||

including | 248.07 | 257.00 | 8.93 | 0.82 | 0.82 | 1.41 | Lower | ||||||

FOR-129 | 677250.93 | 8439111.935 | 323.733 | 300 | -70 | 319.59 | 132.31 | 224.00 | 91.69 | 0.31 | 0.13 | 0.40 | Upper |

including | 179.76 | 201.74 | 21.98 | 0.43 | 0.23 | 0.60 | Upper | ||||||

FOR-131 | 677352.23 | 8439656.498 | 324.962 | 120 | -70 | 330.51 | 100.89 | 129.00 | 28.11 | 0.45 | 0.47 | 0.79 | Upper |

including | 106.00 | 118.28 | 12.28 | 0.57 | 0.68 | 1.07 | Upper | ||||||

and | 298.79 | 307.28 | 8.49 | 0.43 | 0.35 | 0.69 | Lower | ||||||

FOR-133 | 677352.23 | 8439656.498 | 324.75 | 120 | -70 | 379.20 | 75.57 | 99.80 | 24.23 | 0.39 | 0.21 | 0.54 | Upper |

including | 75.57 | 82.00 | 6.43 | 0.49 | 0.47 | 0.83 | Upper | ||||||

and | 277.73 | 308.04 | 30.31 | 0.48 | 0.52 | 0.86 | Lower | ||||||

including | 277.73 | 292.00 | 14.27 | 0.70 | 0.87 | 1.33 | Lower | ||||||

FOR-135 | 677417.805 | 8439507.902 | 324.52 | 120 | -60 | 250.45 | 8.29 | 62.00 | 53.71 | 0.79 | 1.06 | 1.56 | Upper |

including | 32.05 | 50.00 | 17.95 | 1.27 | 1.98 | 2.71 | Upper | ||||||

and | 189.20 | 202.00 | 12.80 | 0.44 | 0.11 | 0.52 | Lower | ||||||

FOR-137 | 677468.510 | 8439593.976 | 324.04 | 120 | -70 | 300.40 | 18.00 | 50.42 | 34.42 | 0.93 | 1.21 | 1.81 | Upper |

including | 21.74 | 42.00 | 20.26 | 1.24 | 1.78 | 2.54 | Upper | ||||||

FOR-138 | 676961.956 | 8439385.443 | 330.345 | 100 | -55 | 380.57 | 245.75 | 277.85 | 32.10 | 0.37 | 0.28 | 0.57 | Upper |

including | 245.75 | 252.03 | 6.28 | 0.49 | 0.57 | 0.91 | Upper | ||||||

FOR-139 | 677367.625 | 8439769.823 | 324.565 | 120 | -70 | 410.16 | 147.39 | 183.17 | 36.32 | 0.40 | 0.15 | 0.50 | Upper |

including | 174.00 | 183.71 | 9.71 | 0.61 | 0.08 | 0.67 | Upper | ||||||

and | 359.00 | 382.87 | 23.87 | 0.38 | 0.23 | 0.55 | Lower | ||||||

including | 364.58 | 373.00 | 8.42 | 0.53 | 0.35 | 0.79 | Lower | ||||||

FOR-140 | 677506.802 | 8439695.304 | 324.652 | 120 | -70 | 300.27 | 50.68 | 64.71 | 14.03 | 0.51 | 0.47 | 0.85 | Upper |

including | 50.68 | 57.67 | 6.99 | 0.71 | 0.72 | 1.24 | Upper | ||||||

and | 244.00 | 269.00 | 25.00 | 0.52 | 0.46 | 0.86 | Lower | ||||||

including | 245.08 | 257.35 | 12.27 | 0.70 | 0.68 | 1.20 | Lower | ||||||

FOR-141 | 676960.285 | 8439473.581 | 326.647 | 100 | -50 | 463.90 | 246.37 | 288.00 | 41.63 | 0.47 | 0.51 | 0.84 | Upper |

including | 253.38 | 272.32 | 18.94 | 0.58 | 0.71 | 1.10 | Upper | ||||||

FOR-142 | 677553.501 | 8439668.36 | 324.67 | 120 | -70 | 270.30 | 17.21 | 50.80 | 33.59 | 0.62 | 0.71 | 1.14 | Upper |

including | 17.21 | 38.20 | 20.99 | 0.81 | 1.03 | 1.56 | Upper | ||||||

and | 217.00 | 233.00 | 16.00 | 0.47 | 0.41 | 0.77 | Lower | ||||||

including | 220.97 | 228.00 | 7.03 | 0.67 | 0.73 | 1.20 | Lower | ||||||

FOR-143 | 676953.271 | 8439689.652 | 330.371 | 120 | -58 | 460.34 | 323.87 | 384.10 | 60.23 | 0.45 | 0.31 | 0.67 | Upper |

including | 327.00 | 333.40 | 6.40 | 0.59 | 0.78 | 1.16 | Upper | ||||||

including | 366.00 | 373.00 | 7.00 | 0.75 | 0.54 | 1.14 | Upper | ||||||

FOR-146 | 676948.493 | 8439593.633 | 328.864 | 120 | -55 | 433.60 | 279.46 | 348.51 | 69.05 | 0.46 | 0.44 | 0.78 | Upper |

including | 295.13 | 307.00 | 10.87 | 0.80 | 1.23 | 1.70 | Upper | ||||||

FOR-148 | 677261.820 | 8439552.380 | 324.305 | 190 | -50 | 220.00 | 116.00 | 190.06 | 74.06 | 0.81 | 1.27 | 1.74 | Upper |

including | 149.61 | 169.00 | 19.39 | 1.80 | 3.61 | 4.43 | Upper |

Notes: | |

1. | Reported intercepts are not true thicknesses as there is currently insufficient data to calculate true orientation. |

2. | Copper equivalent grades (CuEq) are for comparative purposes only. Calculations are uncut and recovery is assumed to be 100% as metallurgical data is insufficient to allow for estimation of metal recoveries. Copper equivalence (CuEq %) is calculated as: CuEq % = Cu % + (Au g/t x 0.7292), employing metal prices of Cu – US$3.00/lb, Au – US$1,500/oz. |

SOURCE Lundin Mining Corporation