From a single asset to a multi-mine global copper producer

Since its inception, Lundin Mining has been driven by a core strength: identifying and unlocking hidden value across the full mining continuum. This began with the discovery of the high-grade Storliden deposit in Sweden in 1997, which was advanced through feasibility, permitting, and construction to production within five years. Though modest in scale, Storliden provided the cashflow and confidence to pursue broader ambitions.

Over the next decade, Lundin Mining rapidly scaled from a single asset to a global portfolio through strategic acquisitions, mergers, and organic growth. Key milestones included acquiring Zinkgruvan in Sweden, merging with Arcon and EuroZinc to add Galmoy and Neves-Corvo, and partnering with Freeport-McMoRan to develop Tenke Fungurume in the DRC. The company further expanded into the U.S. with the acquisition of the Eagle nickel project in Michigan.

In recent years, Lundin Mining has focused on building a top-tier copper portfolio anchored in South America. The acquisition of the Candelaria complex and Caserones mine in Chile, as well as Chapada in Brazil marked major steps forward, followed by transformative moves in the Vicuña District. With the acquisitions of Josemaria and Filo del Sol—alongside a strategic joint agreement with BHP—the company is now positioned to unlock one of the world’s most geologically prospective copper regions and establish a multi-generational mining district foundational to its future growth.

Historical Highlights

Vicuña District Strategy & Portfolio Realignment (2023–2026)

| 2026 | Completes sale of the Eagle Mine and Humboldt Mill to Talon Metals on January 9. |

| 2025 | Completes sale of Neves-Corvo and Zinkgruvan to Boliden on April 16. |

| 2024 | Increases Caserones ownership to 70%; announces joint acquisition of Filo Corp with BHP and 50/50 JV to advance Vicuña Project; announces sale of Neves-Corvo in Portugal and Zinkgruvan in Sweden to Boliden. |

| 2023 | Acquires 51% interest in Caserones copper mine in Chile; achieves new TRIF record of 0.43; relocates head office to Vancouver; pays $206M in annual dividends; records highest-ever annual copper production. |

Copper-Focused Expansion & South American Growth (2019–2021)

| 2021 | Achieves record Total Recordable Injury Frequency (TRIF) rate of 0.54; substantially completes Neves-Corvo Zinc Expansion to double zinc production capacity; announces acquisition of Josemaria Resources for its copper-gold project in Argentina; increases dividend by 125% and pays inaugural performance dividend. |

| 2020 | Restarts Neves-Corvo Zinc Expansion Project after COVID-19 pause; completes Candelaria Mill Optimization Project; increases quarterly dividend by 33%. |

| 2019 | Acquires * Chapada copper-gold mine in Brazil; mines first ore from Eagle East ahead of schedule and under budget; completes Candelaria fleet reinvestment and delivers first ore from South Sector underground. |

Portfolio Diversification & Operational Excellence (2011–2018)

| 2018 | Commissions Los Diques tailings facility at Candelaria ahead of schedule and under budget; advances investment projects across Candelaria, Neves-Corvo, and Eagle East; completes early retirement of $1B in Candelaria acquisition debt. |

| 2017 | Declares first dividend; launches Neves-Corvo Zinc Expansion Project; completes sale of interest in Tenke Fungurume. |

| 2016 | Reaches agreement to sell interest in Tenke Fungurume for $1.136B; begins development of Eagle East. |

| 2015 | Discovers Eagle East deposit; updates life-of-mine plan for Candelaria with two new underground orebodies. |

| 2014 | Acquires 80% interest and operatorship of the * Candelaria Copper Mining Complex in Chile; Eagle mine begins production ahead of schedule and under budget. |

| 2013 | Acquires the Eagle nickel-copper project in Michigan; secures 24% interest in Kokkola Cobalt Refinery in Finland. |

| 2012 | Restarts production at Aguablanca mine. |

| 2011 | Approves second-phase expansion at Tenke Fungurume to increase copper output by 50%. |

Strategic Growth & European Expansion (2004–2010)

| 2010 | Commissions copper plant at * Zinkgruvan; discovers high-grade Semblana deposit at Neves-Corvo. |

| 2009 | Tenke Fungurume produces first copper cathode; expanded copper plant at Neves-Corvo begins production. |

| 2008 | Discovers new zinc-copper zone at Neves-Corvo and announces expansion of copper plant. |

| 2007 | Acquires Tenke Mining Corporation, adding the Tenke Fungurume project in DRC; expands Neves-Corvo zinc production and initiates copper production at Zinkgruvan; acquires Rio Narcea Gold Mines, gaining the nickel-copper Aguablanca mine in Spain. |

| 2006 | Merges with EuroZinc Mining Corporation, gaining the Neves-Corvo mine and Aljustrel project in Portugal. |

| 2005 | Merges with Arcon International Resources, adding the Galmoy mine in Ireland; acquires full ownership of North Atlantic Natural Resources. |

| 2004 | The company acquires the Zinkgruvan zinc-lead-silver mine in Sweden; changes name to Lundin Mining Corporation and graduates to the Toronto and O-list of Stockholm stock exchanges. |

Foundation & Early Discovery (1994–2003)

| 2002 | Storliden mine begins commercial production. |

| 2001 | North Atlantic Natural Resources enters a joint venture with Boliden Mineral AB to develop the Storliden mine. |

| 1997 | Through a 39% ownership in North Atlantic Natural Resources, the company discovers the high-grade Storliden deposit in northern Sweden. |

| 1994 | Lundin Mining is incorporated under the name South Atlantic Diamonds Corp., marking * Adolf Lundin’s ambition to build a base-metals company. |

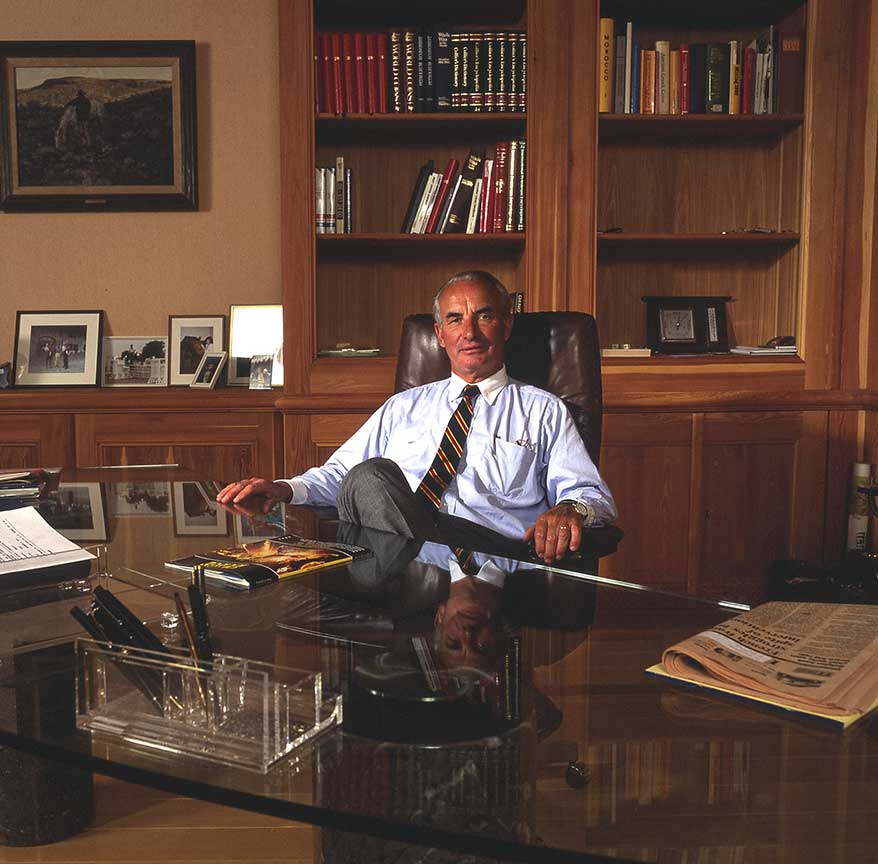

Lukas founded Lundin Mining together with his father Adolf in the mid-1990s and was a member of the Board of Directors and Chair of the company for more than 25 years until he stepped down in May 2022. In his role as Chairman, Lukas oversaw Lundin Mining’s development from an exploration-stage company into a global mid-tier producer with a strong copper focus and a portfolio of world-class assets.

On July 26, 2022, Lukas passed away after a courageous battle with glioblastoma, an aggressive form of brain cancer. Before his passing, Lukas created a new legacy: the Lundin Cancer Fund, an international initiative to improve treatments that increase the survival rate and quality of life for patients with brain cancer.

The many successes of Lundin Mining owe directly to Lukas’ extraordinary strategic foresight, matched only by his relentless drive. His guidance and support for his colleagues is deeply missed, however, his pursuit and vision of creating a world-class base metals company lives on.